Commercial

Zurich and Beazley agree £8.2bn deal

Zurich Insurance Group has agreed the terms of a firm all-cash offer to buy Beazley for £8.2bn.

Diary of an Insurer: Corin Underwriting's Louis Gibson

The working week of Louis Gibson, development underwriter at Corin Underwriting, is a lively mix of new business, debating football results, and championing the MGA's NextGen culture.

British Insurance Awards 2026 deadline extended

For those of you rushing to put the finishing touches to your 2026 British Insurance Awards entry.

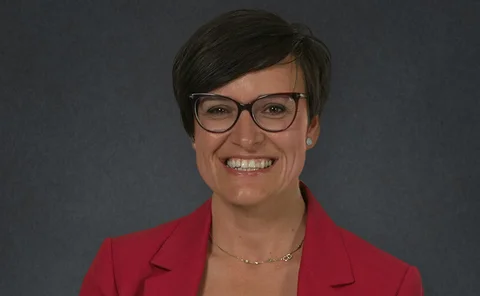

Markel International’s Hogan on how cover for environmental contamination is evolving

View from the top: Olivia Hogan, senior environmental underwriter at Markel International, looks at how tighter regulations, industry awareness and risk management are changing approaches to environmental liability cover.

Threat actors showing dramatic shift in cyber-attack executions

Data has indicated a dramatic shift in how threat actors are executing prolonged attacks on organisations.

Centuries old Lloyd's entities join forces

The 290-year-old maritime risks partner for the London market, Lloyd’s List Intelligence, is set to evolve its ecosystem by moving the Lloyd’s Agency Network under its management.

Hiscox delivers record profit and plots next phase

Hiscox has delivered its third consecutive year of record profits and set out ambitions for further acceleration through to 2028.

Stanford replaces Thaker as Sompo UK CEO

Aspen UK CEO Sarah Stanford will lead all of Sompo UK’s property and casualty insurance operations, replacing outgoing CEO Bob Thaker.

Sign up for Claims Club to hear from London Fire Brigade and others

Fire risk in residential and mixed-use buildings is evolving in ways that are not always fully captured by data, models or regulation.

Big Interview: Andrew Burke, HSB UK & Ireland

After stepping back from executive life to spend more time with his three daughters, Andrew Burke has returned as CEO of HSB UK & Ireland with plans to grow the specialist insurer and strategic partnerships.

Aviva targets financial lines expansion

Aviva is gearing up to for a number of financial lines launches across both its London and regions operations as it attempts to build scale in segment.

Diary of an Insurer: CFC's Chris Mullan

Chris Mullan, head of data and artificial intelligence at CFC, juggles deeply technical work, product delivery and the fast-moving realities of AI adoption with life as a father of five, rifle shooting and South Downs walks.

Dunny or delight? Rating Australian forays into UK insurance

Content Director’s View: With Australian firm AUB Group doubling down on its UK growth plans with a deal for Prestige Insurance Holdings, Jonathan Swift reviews other notable Antipodean overseas insurance expansion plans to assess its chances of success.

Geopolitical instability and trade policy risk rocking marine insurance

Escalating geopolitical tensions, from conflict-driven shipping attacks and vessel detentions to sanctions, tariffs and the growth of shadow fleets, are reshaping global trade routes. Against this backdrop, Tim Evershed observes significantly heightened…

Softening market: will underwriters hold their nerve?

Whether the softening market will see some underwriters lose their discipline and how it will reshape broker/carrier relations is the focus of the latest episode of the Insurance Post Podcast.

Big Interview: Russell White, NPA Insurance and Peach

Russell White, CEO of NPA Insurance and Peach, sits down with Harry Curtis to explain how the government’s plans to reshape the NHS are fuelling ambitions to write a varied portfolio of MGA and schemes business.

Zurich given deadline extension for Beazley bid

Zurich has been given a deadline extension to submit its firm offer for Beazley.

Diary of an Insurer: Axa’s Brendon Moodley

From 5am gym sessions to steering major technology initiatives, Brendon Moodley, head of data platforms and product delivery at Axa UK, blends discipline, leadership and family time that includes watching Disney films that sometimes leave him holding…

Apologies to Donaldson: Passing on the crown for shortest GI CEO stint

Content Director’s View: With a host of recent – mostly surprising – announcements relating to short leadership/CEO stints, Jonathan Swift revisits his column from last February where he awarded the crown for briefest tenure at the top to Ardonagh’s Ian…

Enter Best Insurance Employer 2026 today

If you work for one of the greatest employers in the insurance industry and want to shout about it, make sure you complete Insurance Post’s Best Insurance Employer survey today.

Insurers argue furlough deductions permitted by policy wordings

Insurers finished their submissions to the Supreme Court on the issue of whether or not furlough payments are deductible from Covid-era business interruption claims payouts this morning (12 February), hitting back at arguments advanced yesterday by…